BNPLs [EGY, KSA, UAE]

Who is this for: Product managers, business owners, and stakeholders who want to offer installment-based payment options to their customers

Outcome: Understand how BNPL payments work, the supported providers, regional availability, and how customers complete payments

BNPLs allow merchants to offer their customers flexible payment options, letting them split purchases into installments while receiving the full payment upfront. BNPL helps increase conversion rates, average order value, and customer satisfaction by providing more affordable and manageable payment options.

Valu

EGY

Souhoola

EGY

Contact

EGY

SYMPL

EGY

Tabby

KSA, UAE

Tamara

KSA, UAE

Aman

EGY

Forsa

EGY

TRU

EGY

MOGO

EGY

Klivvr

EGY

HALAN

EGY

Premium

EGY

Seven

EGY

How BNPL works

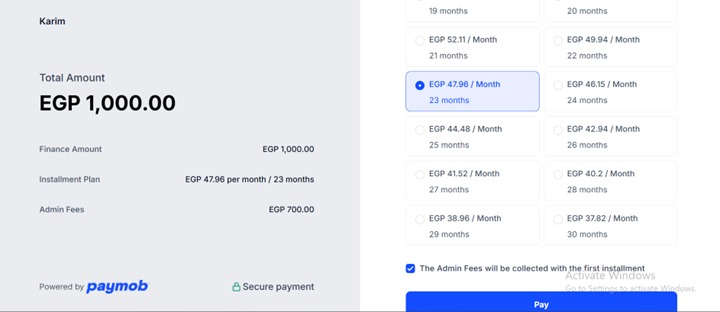

- Customer selects BNPL at checkout The customer chooses to split the payment into multiple installments.

- The merchant receives full payment upfront Paymob pays the merchant immediately while collecting installments from the customer.

- Customer repays in installments The customer pays the agreed amounts over time according to the chosen schedule.

Key Providers

Valu [EGY]

Supported Integration Channels

Souhoola [EGY]

Supported Integration Channels

Aman Installments [EGY]

Supported Integration Channels

Tabby [KSA, UAE]

Supported Integration Channels

Tamara [KSA, UAE]

Supported Integration Channels

Forsa [EGY]

Supported Integration Channels

Contact [EGY]

Supported Integration Channels

Sympl [EGY]

Supported Integration Channels

Seven [EGY]

Supported Integration Channels

TRU [EGY]

Supported Integration Channels

KLIVVR [EGY]

Supported Integration Channels

MOGO (MID Takseet) [EGY]

Supported Integration Channels

Halan [EGY]

Supported Integration Channels

Premium [EGY]

Supported Integration Channels

Was this section helpful?

What made this section unhelpful for you?

On this page

- BNPLs [EGY, KSA, UAE]