Overview

Who is this for - Anyone involved in setting up or managing payments with Paymob, including Merchants, Developers, and Product or technical teams

Outcome - know where to start, what you need, and which path makes the most sense for you

Paymob helps businesses accept online and in-person payments securely and at scale. Whether you’re just getting started with payment links, setting up an online store, or building a custom checkout from scratch, Paymob gives you a few different ways to integrate so you can choose what fits your business and technical setup.

This overview will help you understand what Paymob offers, which payment methods are available, and how to get up and running with the right integration.

Who Is This For?

In our documentation, to help you with navigation visual indicators is used to clarify the intended audience. When you see the People figure, the content applies to all users, including marketers and non-technical roles. When you see a code figure, the content is intended specifically for developers and may include technical or implementation-focused details.

Everyone

Essential information for anyone getting started with Paymob.

Developers

Detailed API documentation, integration guides, and technical specifications. Ideal for those implementing Paymob's payment solutions directly into applications or platforms.

Payment methods available

Paymob supports a range of payment methods commonly used, so your customers can pay the way they prefer:

Payment links | Freelancers, invoicing, social selling | Minutes | None |

E-commerce plugins | Shopify, WooCommerce, Magento | Hours | Low |

Hosted checkout | PCI-compliant payment redirection | Days | Medium |

Pixel (Embedded) | Embedded checkout experience | Days–Weeks | High |

Mobile SDKs | iOS, Android, Flutter, React Native | Days–Weeks | Hig |

Ways to integrate with Paymob

There’s more than one way to integrate Paymob. The right option depends on how technical your setup is and how quickly you want to launch.

Sandbox (Test)

What it's for: Development and testing

When to use it: While building and QA

Production (Live)

What it's for: Real payments When to use it: After go-live approval

Not sure where to start?

Use this quick guide:

- No developers involved? → Start with Payment Links

- Running a Shopify or WooCommerce store? → Use an E-commerce Plugin

- Want a hosted payment page → Go with Hosted Checkout

- Want an embedded payment experience, not redirection → Go with Pixel

- Building a mobile app? → Use the Mobile SDKs

How payments work (at a high level)

No matter which integration you choose, the payment flow stays mostly the same:

You don’t need to handle sensitive card data yourself. Paymob takes care of that.

Test vs. live environments

Paymob gives you two environments to work with:

For all integrations

- A Paymob merchant account

- Access to the Paymob Dashboard

- Completed business verification

Both environments use the same base URL.

For API or SDK integrations

- API Secret Key and Public Key

- Integration ID(s) for your payment methods

- A webhook endpoint

- Success and failure redirect URLs

What you’ll need before you begin

Here’s a quick checklist to help you prepare.

For e-commerce plugins

- Admin access to your platform

- Integration ID(s)

- API key, secret key, and public key

Where to go next

Depending on what you want to do, here’s where to continue:

Your goal | Start here |

Accept your first payment quickly | Quick start guide |

Set up API credentials | API keys setup |

Test your integration | Test environment & credentials |

Prepare for production | Integration checklist |

Get guided setup | Onboarding wizard |

Need help?

If you get stuck, you’re not on your own:

- Documentation: Use the sidebar to explore all topics

- API reference: Full API details live under Developer Reference

- Postman collection: Try the APIs quickly using Postman

- Support: support@paymob.com

- Community: Join the Paymob Developer Community

What made this section unhelpful for you?

On this page

- Overview

Integration Checklist

Who is this for - Developers, product managers, and business owners who are preparing to launch Paymob in production

Outcome - Confirm that your integration is complete, tested, and ready for a smooth go-live

Overview

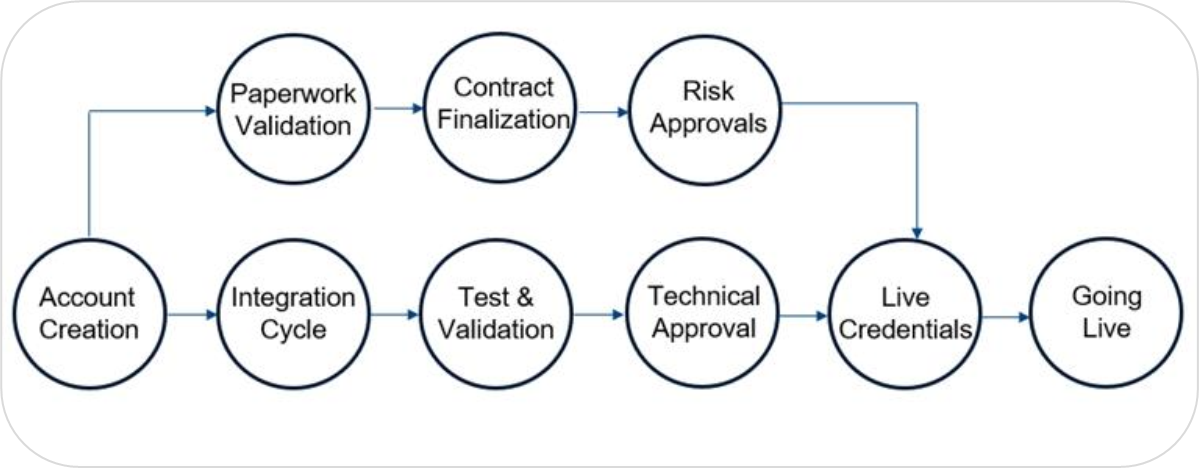

Within this section, we will help outline the end-to-end onboarding and go-live journey for integrating with our platform. It shows the required business, technical, and risk steps from account setup and documentation through testing, approvals, and credential issuance. Each stage must be completed in sequence to ensure a secure, compliant, and smooth transition to production.

Account Creation

The merchant account is created, granting access to the dashboard and test environment.

Paperwork Validation

Business and legal documents are reviewed to verify the merchant’s information and compliance.

Contract Finalization

Commercial terms are confirmed and the contract is signed by both parties.

Risk Approvals

The merchant is assessed by the risk team based on business model and transaction activity.

Integration Cycle

The merchant integrates the payment solution using APIs, SDKs, or plugins in the test environment.

Test & Validation

Test transactions are completed to ensure correct payment flow and system behavior.

Technical Approval

The integration is reviewed to confirm it meets technical and security requirements.

Live Credentials

Production credentials are issued to enable live transactions.

Going Live

The merchant starts accepting real customer payments.

What made this section unhelpful for you?

On this page

- Integration Checklist

Onboarding Wizard

Who is this for - Everyone

Outcome - Build the integration plan using this interaction wizard

Overview

The Onboarding Wizard is an interactive tool designed to help you build a clear and tailored integration plan based on your business needs and technical setup. Through a series of simple choices, such as your platform, preferred checkout experience, and required features, the wizard maps out the recommended Paymob integration path for your use case

What made this section unhelpful for you?

On this page

- Onboarding Wizard

Dashboard

Who is this for - Everyone

Outcome - Full and quick guide for the Paymob dashboard.

Overview

Our Dashboard allows you to monitor and analyze all payment activities from a single, centralized platform. You will have access to detailed payment histories, transaction insights, and comprehensive analytics to support leading informed business decisions.

Through the video below, we will guide you from the first steps of Signing Up until your full Account Creation.

Sign-up

Account Configuration

Manage and control your account’s core settings directly from the Settings tab, including:

Business Branding

- Update your business name, account type, sector, and industry

- Add and manage social media links

- Upload and manage your business logo

Contact Information

- Edit company name

- Manage phone numbers

- Update email addresses

Account Information

- Access integration credentials (Secret Key, Public Key, API Key, HMAC Secret)

- View account mode and status (Live / Test)

Notifications & Reports

- Enable or disable selected notification settings

- Control reporting and alert preferences

Checkout Customization

From the Merchant Dashboard, you can fully personalize the checkout experience to align with your brand and business needs.

Branding Customization

- Add your business logo and details

- Customize brand colors

- Select fonts that match your brand identity

- Choose button styles (Rounded or Rectangular)

Payment Experience

- Choose how payment methods are displayed (Tabs or List)

- Enable or disable specific payment methods

- Show or hide billing address fields

- Display purchased item details

- Enable the “Save Card” option

- Activate Split Payments and control the number of cards allowed

- Display Terms & Conditions link

- Enable or disable payment retries

Post-Payment Experience

- Show a custom thank-you message

- Customize the post-payment redirection flow

Payment Integrations

Manage all payment integrations from the Payment Integrations tab:

- Retrieve integration credentials based on selected mode (Live / Test)

- Add test integrations for payment methods:

- Cards (MIGS)

- Wallets

- Kiosk payments

- Update callback URLs for each integration

Transactions Management

From the Transactions tab, you can monitor and manage all transaction activities:

- Filter transactions using:

- Date range

- Transaction ID

- Order ID

- Merchant Order ID

- Transaction status

- Access full transaction details, including:

- Transaction and order details

- Shipping and billing information

- Installment details (if applicable)

- Perform supported actions based on transaction status:

- Refund

- Void

- Capture

Orders Management

Use the Orders tab to track and manage all orders efficiently:

- View orders by selected mode (Live / Test)

- Filter orders using:

- Date range

- Order ID

- Merchant Order ID

What made this section unhelpful for you?

On this page

- Dashboard

Overview

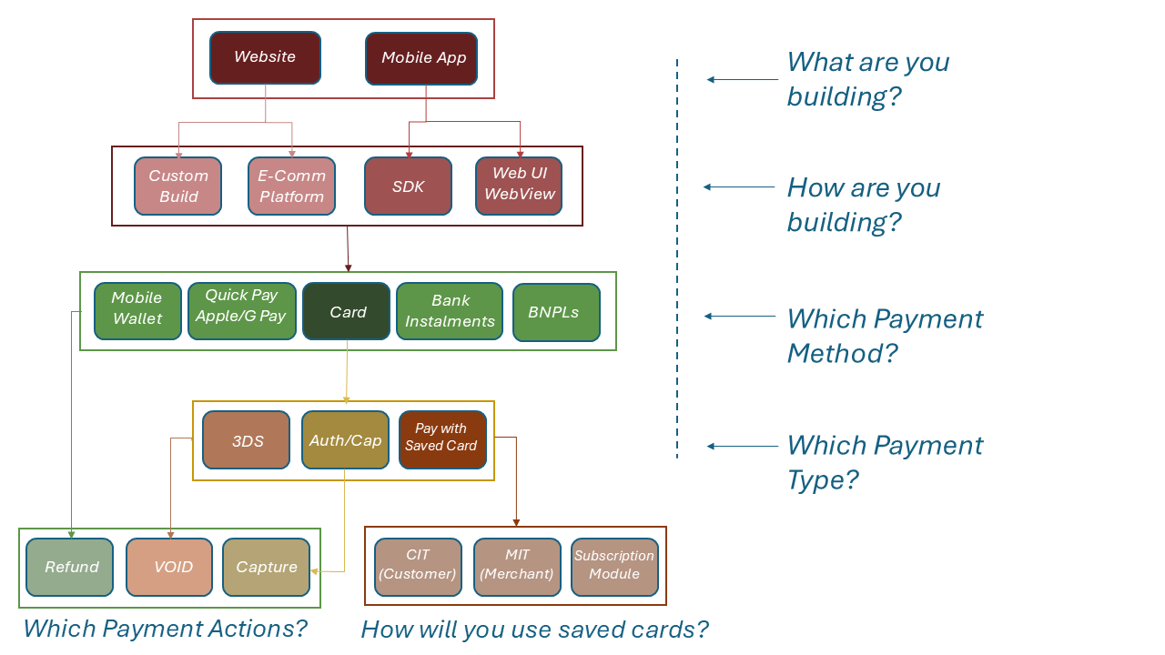

Who is this for - Product managers and developers who need a high-level overview to plan the payment feature for their app or website

Outcome - Understand the overall payment flow and the available integration options

Overview

The figure below is a high-level view of the payments architecture, from user touchpoints to transaction execution, designed to guide decisions across wallets, cards, installments, and post-payment actions. This will help you map what you’re building, how you’re integrating, and which payment methods and flows you support.

Phase 1: Define Your Product & Integration Method

Start by defining what you are building and how you will connect to us.

Phase 2: Choose Your Payment Options

Select the payment methods and types that match your needs.

Phase 3: The Payment Actions you can take

Determine what payment actions you’ll perform.

1. What are the payment actions you'll perform?

Please check the Managing Payment Actions section to know more about the available payment actions and how to do each one through the Paymob dashboard or APIs.

If you are still confused regarding the path you'll follow to implement your needed payment experience, please send an email to support@paymob.com, and we'll be glad to help you get the best payment experience for your business.

What made this section unhelpful for you?

On this page

- Overview

No Code

Who is this for - Product managers and Merchants (non-technical) who want to start accepting online payments without any coding or development

Outcome - Start accepting online payments using Payment Links even without a website or development team.

Overview

Option A: Payment Links (fastest start)

Payment links are ideal when you don’t have a website. You can share them via WhatsApp, social media, or any communication tool, and your customer pays on a hosted checkout page.

Common use cases

- Event tickets and reservations

- Small businesses selling without a website or POS

- Adding a payment link to an electronic invoice

Security and compliance

With hosted checkout, your customers complete payment on a payment page handled by the payment provider, which helps keep sensitive card data off your website.

Go live checklist

- Confirm your business profile is complete and approved (documents).

- Make sure the payment methods you want are enabled on your account.

- Run a full test: link creation → payment → confirmation → refund/void (if applicable).

- Train your team on what “paid” looks like in the dashboard (so orders don’t get missed).

On this page

- No Code

APIs

Who is this for - Product managers and developers who need a high-level overview of how to integrate through APIs and our available checkout experiences

Outcome - Understand the overall API payment flow, the available checkout options, and how payment results are securely communicated back to your system

When should you use APIs?

Use Paymob APIs if you are:

- Building a custom website without a CMS or ready-made plugin

- Using a platform that allows calling third-party APIs but has no direct Paymob integration

- Building a mobile app and choosing to use a web-based checkout in a WebView instead of a native SDK

APIs give you flexibility while still relying on Paymob’s secure payment infrastructure.

Integration flow

What made this section unhelpful for you?

On this page

- APIs

Plugins

Integrate Paymob payments into your existing e-commerce platform without writing code

When should you use Plugins? Use Paymob Plugins if you are: * Running an online store on a supported e-commerce platform * Looking for a no-code or low-code integration solution * Want to be up and running quickly without custom development

Plugins

On this page

- Plugins

Mobile SDKs

Who is this for - Product managers and developers who need a high-level overview of how to integrate through Mobile SDKs

Outcome - Understand the overall Mobile flow, the available checkout options, and how payment results are securely communicated back to your system

When should you use Mobile SDKs?

Use Paymob Mobile SDKs if you are building a native mobile application and want a checkout experience that feels fully integrated with your app.

Mobile SDKs are recommended when you want a native UI experience without using WebViews

Integration flow

What made this section unhelpful for you?

On this page

- Mobile SDKs

Overview

Who is this for: Product managers, business owners, and stakeholders who need a high-level overview of Paymob’s supported payment methods and features

Outcome: Identify the supported payment methods and features, and decide which ones best fit your business needs

Paymob enables businesses to accept and manage digital payments through a wide range of payment methods and Core features.

What made this section unhelpful for you?

On this page

- Overview

Payment Methods

Who is this for: Product managers, business owners, and stakeholders who need a high-level overview of Paymob’s supported payment methods and their use cases.

Outcome: Identify the supported payment methods and decide which ones best fit your business needs

Overview

Paymob supports a wide range of payment methods to help businesses accept payments across different customer preferences and markets. Each payment method serves a specific use case and may vary in terms of availability, customer experience, and supported features.

Supported Payment Method Types

Card Payments

Allow customers to pay using debit or credit cards. This is the most common payment method and supports standard online card payment flows

Mobile Wallets

Enable payments using mobile wallets linked to a customer’s phone number

On this page

- Payment Methods

Core Features

Who is this for: Product managers, business owners, and stakeholders who want a high-level overview of Paymob’s core capabilities, without diving into technical implementation details

Outcome: Understand the key payment management and value-added features offered by Paymob, and identify which features are most relevant to your business mode

Paymob provides a set of core payment features that help merchants manage transactions, enhance customer experience, and optimize business operations. Each feature addresses specific business needs, from controlling funds to enabling flexible payments and generating insights.

Core Features Overview

Subscription Module

Automate recurring payments by charging customers periodically based on predefined subscription plans.

Pay With Saved Cards

Allows returning customers to pay quickly without re-entering card details, streamlining checkout and increasing repeat purchases.

Authorization & Capture (Auth/Cap)

A two-step payment flow that lets merchants reserve funds first and collect them later, offering control over settlement timing and flexibility in transaction amounts.

Split Features

Split a single payment across multiple parties (Split Amount) or allow customers to use up to three cards to complete the same payment (Split Payment).

Convenience Fee

Merchants can add additional charges to cover transaction processing costs or service fees, clearly presented to customers at checkout.

Transaction Inquiry & Reports

Provides insights into payments through detailed reports and Transaction Inquiry APIs, helping merchants track performance and reconcile accounts.

On this page

- Core Features

Managing Payments

Who is this for - Product managers, business owners, and stakeholders who want a clear understanding of how to manage payments

Outcome - Understand the different types of payment management actions and when to use each one

Paymob gives you flexible control over how payments are handled throughout their lifecycle. This section focuses on the actions available to manage transactions once they exist, allowing you to cancel, reverse, or finalize payments based on your business needs.

Available Actions

The following actions help you manage different payment scenarios. Each action is covered in detail in its own dedicated page.

On this page

- Managing Payments

Authentication Request (Generate Auth Token)

Who is this for: Developers

who implement the integration

Outcome: Generate an Auth token to use for authentication across multiple API endpoints (e.g., Subscription APIs, create QuickLink).

What made this section unhelpful for you?

Response

What made this section unhelpful for you?

Authentication Request (Generate Auth Token)

Outcome: Generate an Auth token to use for authentication across multiple API endpoints (e.g., Subscription APIs, create QuickLink).

You'll need to pass your API Key in the body of the request

Body Parameters

Response

Response Attributes

Show child attributes

What made this section unhelpful for you?

Base URL

Production:

Sandbox:

Response

What made this section unhelpful for you?

Overview

Outcome: Understand what Paymob's Payment Intention is, and its APIs

Detention

Intention: The initial component of any payment that contains key details such as the payment amount, customer information, currency, and the available payment methods.

When will it be used?

It will be used each time you need to create a payment. It will be used with:

- Normal redirection integration on a website

- Embedded experience (Pixel) on a website

- Integrating with our SDKs

- Create subscription

- Auth/Cap payment model

- Pay with saved cards

Available actions

Create Intention

You can create an intention by using the Create Intention API, passing the amount that should be paid, customer info, and other information.

Update Intention

You can update an already existing intention by using the Update Intention API, passing the amount that should be paid, customer info, and other information.

What made this section unhelpful for you?

On this page

- Overview

Create Intention

Outcome: Create an Intention that will be used to complete a payment, either via APIs or through one of our UI options.

Authorization

Add your “secret key“ in the authorization header preceded by the word "Token ".

Key values in the response

You'll receive a response, which is an object that represents an intention and includes all the intention details.

- Important parameters: Order ID: Paymob order ID, which will be received in the transaction callback and can be used to correlate the transaction to the order on your system.

- Intention ID: Paymob intention ID can be used to do the same as the Order ID.

- Client Secret: A unique, intention-specific token used to redirect the customer to Paymob’s Unified Checkout or to render Paymob’s Pixel component.

Header Parameters

This is the secret key which you can get from your Dashboard

Body Parameters

The total transaction amount, expressed in cents.

The currency in which the transaction is processed. This must match the currency of the selected Integration ID.

The Integration ID(s) used to process the payment. Values can be provided as integers (e.g., 1256) or as names enclosed in quotes (e.g., "card"). The status (Live/Test) of the provided ID(s) should match the status of the secret key used for authentication.

Show child attributes

Show child attributes

Show child attributes

A set of additional custom parameters provided by the merchant. These values are returned in callbacks under the payment key claims object.

Show child attributes

A unique reference associated with the transaction or order, returned in the transaction callback under merchant_order_id.

A callback URL that receives a POST request with full transaction details after the transaction succeeds or fails. Supported only with card Integration IDs. This endpoint

A URL to which the customer is redirected after the transaction completes, with transaction details included as query parameters. Supported only with card and wallet payment methods. > ⚠️ Important Notes

The endpoint used in the notification URL will receive the transaction callback (transaction details) and the card token (for pay with saved card features)

Response

Response Attributes

Show child attributes

Show child attributes

Show child attributes

Show child attributes

What made this section unhelpful for you?

Base URL

Production:

Sandbox:

Response

What made this section unhelpful for you?

Update Intention

Outcome: Update the (amount, billing_data, special_reference, and notification_url) of a already created intention

Authorization

Add your “secret key“ in the authorization header preceded by the word "Token ".

Header Parameters

Bearer token authentication. Format: "Token YOUR_SECRET_KEY"

Path Parameters

Client secret token for completing the payment

Body Parameters

The item amount, expressed in cents and located under the items array. When multiple items are provided, the sum of all item amounts must equal the total transaction amount.

Currency code (e.g., EGP, USD)

Available payment methods for this transaction

Show child attributes

List of items in the order

Show child attributes

Customer billing information

Show child attributes

Additional custom data

Show child attributes

A unique reference associated with the transaction or order, returned in the transaction callback under merchant_order_id.

A callback URL that receives a POST request with full transaction details after the transaction succeeds or fails. Supported only with card Integration IDs. This endpoint

A URL to which the customer is redirected after the transaction completes, with transaction details included as query parameters. Supported only with card and wallet payment methods.

Response

Response Attributes

Show child attributes

Unique identifier for the transaction

Show child attributes

Client secret token for completing the payment

Available payment methods for this transaction

Show child attributes

Special reference identifier for merchant use

Additional custom data

Show child attributes

Indicates if the transaction has been confirmed

Current status of the record

Card details used for the transaction

List of saved card tokens

Type of object returned

What made this section unhelpful for you?

Base URL

Production:

Sandbox:

Response

What made this section unhelpful for you?

Overview

Outcome: Understand the checkout experiences supported by Paymob, and know when to use Unified Checkout vs. Pixel.

Paymob offers two flexible checkout experiences to help you accept payments online. Each experience supports different merchant needs and integration preferences, while both rely on Paymob’s Intention API as the initial step.

Checkout Options

Unified Checkout

Unified Checkout is Paymob’s redirect-based payment experience. When a customer is ready to pay, you redirect them to Paymob’s hosted checkout page, where they enter their payment details and complete the transaction.

The flow generally involves creating a payment intention, then directing the customer’s browser to the hosted checkout using the generated client secret

Pixel

Pixel is Paymob’s JavaScript SDK that enables an embedded checkout experience directly on your site or application. Instead of redirecting the customer to a separate page, Pixel allows you to integrate payment elements inside your own UI.

Pixel is ideal for:

- Seamless, branded checkout experiences

- Embedded Card, Apple Pay, and Google Pay

- Businesses that want checkout UI inside their website without redirection

Pixel accepts configuration (such as payment methods and an HTML container ID) and uses the client secret from the previously created intention to render the payment UI in place.

How They Work

Both checkout experiences share the same initial requirement:

- Create an intention Use the intention API to specify the payment amount, currency, and available methods. This returns a client secret that is unique to that payment attempt.

- Render checkout

- Unified Checkout: Redirect the customer to a hosted payment page using the client secret.

- Pixel: Embed the payment UI inside your site using the SDK and client secret.

Choosing Between Unified Checkout and Pixel

Checkout location | Redirect to hosted page | Embedded on your site |

Branding control | Standard Paymob look, with simple customization | Matches your UI |

Setup complexity | Simple | Requires SDK integration |

Best for | Quick integration | Custom embedded experience |

What made this section unhelpful for you?

On this page

- Overview

Unified Checkout (Redirection)

Outcome: Redirect the customers to Paymob's Unified Checkout to process and complete the payment, and customize the Unified Checkout.

Query Parameters

Client Secret

Public Key

Query Parameters

A unique, intention-specific token used to redirect the customer to Paymob’s Unified Checkout or to render Paymob’s Pixel component.

What made this section unhelpful for you?

Base URL

Production:

Sandbox:

What made this section unhelpful for you?

Pixel (Embedded)

Outcome: Integrate Paymob's pre-built UI (Pixel) in the merchant's checkout.

Pre-Requisites

- Integrate the Intention API as described in the documentation for the Create Payment Intention API.

- Include the following script and stylesheets in your HTML file

Usage

Create a new Pixel instance

new Pixel({ publicKey: 'egy_pk_live_XXXX',

clientSecret: 'egy_csk_live_XXXX',

paymentMethods: [ 'card','google-pay','apple-pay'],

elementId: 'paymob-elements',

disablePay: false,

showSaveCard :true,

forceSaveCard : true,

beforePaymentComplete: async (paymentMethod) =>

{

console.log('Before payment start');

return true

},

afterPaymentComplete: async (response) =>

{

console.log('After Bannas payment');

}, onPaymentCancel: () => {

console.log('Payment has been canceled');

}, cardValidationChanged: (isValid) => {

console.log("Is valid ? ", isValid)

}, customStyle: {

Font_Family: 'Gotham',

Font_Size_Label: '16',

Font_Size_Input_Fields: '16',

Font_Size_Payment_Button: '14',

Font_Weight_Label: 400,

Font_Weight_Input_Fields: 200,

Font_Weight_Payment_Button: 600,

Color_Container: '#FFF',

Color_Border_Input_Fields: '#D0D5DD',

Color_Border_Payment_Button: '#A1B8FF',

Radius_Border: '8',

Color_Disabled: '#A1B8FF',

Color_Error: '#CC1142',

Color_Primary: '#144DFF',

Color_Input_Fields: '#FFF',

Text_Color_For_Label: '#000',

Text_Color_For_Payment_Button: '#FFF',

Text_Color_For_Input_Fields: '#000',

Color_For_Text_Placeholder: '#667085',

Width_of_Container: '100%',

Vertical_Padding: '40',

Vertical_Spacing_between_components: '18',

Container_Padding: '0'

},});

</script>Properties

The full list of properties is as follows:

publicKey | String | To know how to get your public key, please check the Getting Integration Credentials page. |

clientSecret | String | Once you fire the Intention API, you will receive “client_secret” in the API Response, which will be used in the Pixel SDK. Client Secret is unique for each Order, and it expires in an hour. |

paymentMethods | Array of String | Pass “card” for Card Payments, "google-pay" for Google Pay, and “apple-pay” for Apple Pay. |

elementId | String | ID of the HTML element where the checkout pixel will be embedded. |

disablePay | Boolean | Pass true. If you don’t want to use Paymob’s Pay Button for Card Payment, in this case, you will dispatchEvent with the name (payFromOutside) to fire the pay. |

showSaveCard | Boolean | If this option is set to TRUE, users will have the option to save their card details for future payment. |

forceSaveCard | Boolean | If this option is set to true, the user's card details will be saved automatically without requiring their consent |

afterPaymentComplete | Function | This Functionality will be processed after payment is processed by Paymob. Check the full example below. |

customStyle | Object | You can pass custom styles; for more details, check the full example below. |

Events

We have one event that will be used if you want to trigger the payment from a custom Pay button, not Pixel's Pay button:

Event | Definition |

payFromOutside | In case you need to use you pay button instead of the SDK pay button. |

const button = document.getElementById('payFromOutsideButton');

button?.addEventListener

('click', function ()

{

// Calling pay request

const event = new Event('payFromOutside');

window.dispatchEvent(event);

});Functions

The full list of functions is as follows:

cardValidationChanged | This Functionality will be processed whenever the card validation status changes. | Writes the function logic |

beforePaymentComplete | Merchants can implement their own custom logic or functions before the payment is processed by Paymob. Check the full example below. | Writes the function logic |

afterPaymentComplete | This Functionality will be processed after payment is processed by Paymob. Check the full example below. | Writes the function logic |

onPaymentCancel | This function applies exclusively to Apple Pay. Merchants can implement their own custom logic to handle scenarios where a user cancels the Apple Pay payment by closing the Apple Pay SDK. | Writes the function logic |

updateIntentionData | Update the intention data within the SDK if any changes occur to the intention. For more details, refer to the Intention Update API documentation. | Calls the function |

Full sample

What made this section unhelpful for you?

On this page

- Pixel (Embedded)

Overview

Outccome: Know the available Mobile SDKs and how it works.

Paymob’s Mobile SDKs enable native payment acceptance within mobile applications. They support multiple mobile platforms and frameworks, allowing merchants to integrate Paymob’s checkout experience directly into their apps using a consistent payment flow.

Supported Mobile SDKs

How does it work?

Mobile SDKs use the same backend flow as other Paymob checkout experiences. Before starting a payment in the mobile app, your system must create a payment intention and obtain a client secret, which will be used to initialize the SDK.

What made this section unhelpful for you?

On this page

- Overview

IOS SDK

Outcome: Integrate Paymob's native iOS SDK

Installation

You can install the iOS SDK in one of two ways. Choose only one method.

Option 1: Cocoa installation

PaymobSDK is available through CocoaPods.

Step 1: Add Pod Dependency

Simply add the following line to your Podfile:

pod 'Paymob'Step 2: Install Pods

Run pod install command in the terminal

Step 3: Open Workspace

Open your project using the.xcworkspace file

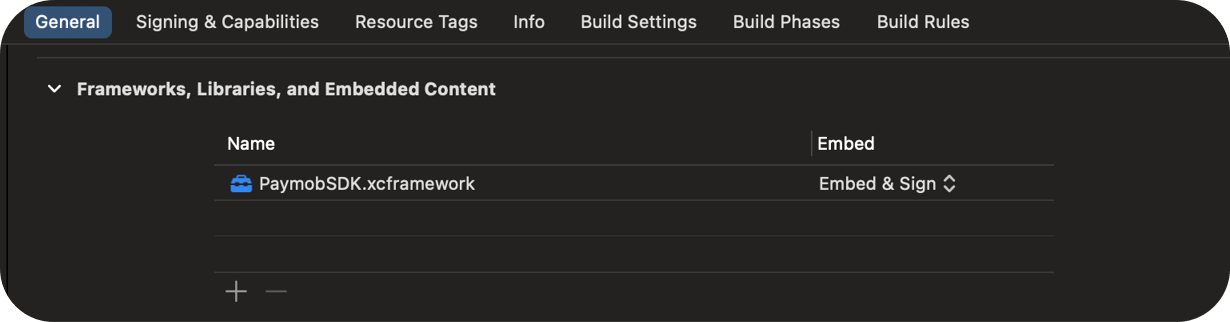

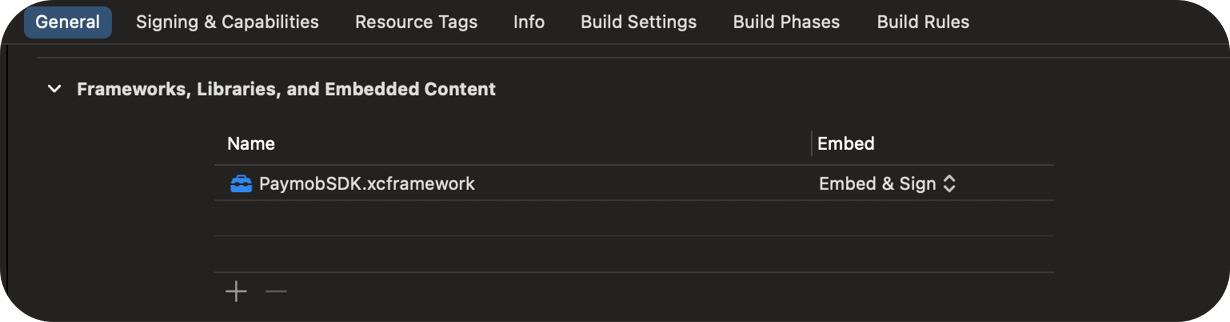

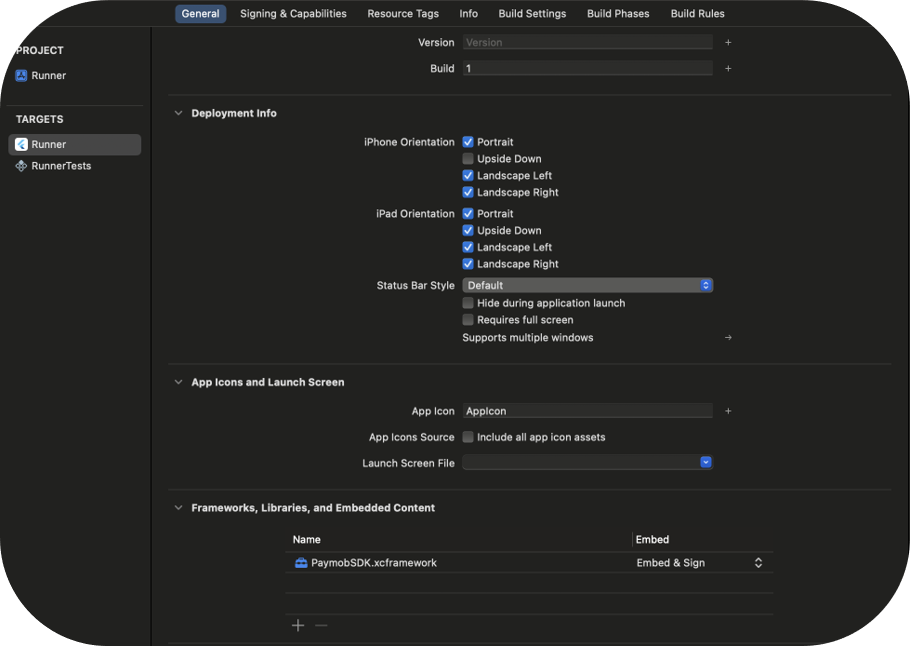

Step 4: Change the embedding option to "Embed & Sign"

In the general settings of your project, under libraries and frameworks, change the library from "Do not embed" to "Embed and Sign"

Manual Installation

Step 1: Download the SDK

Download the SDK from the provided link and extract it on your local machine.

Step 2: Add the SDK files to your project

Copy the extracted SDK files and place them inside your project’s folder structure.

Step 3: Add the SDK to Xcode

Open your project in Xcode, then drag and drop the PaymobSDK.xcframework into General → Frameworks, Libraries, and Embedded Content.

Step 4: Embed and sign the SDK

In Frameworks, Libraries, and Embedded Content, change the SDK option from Do Not Embed to Embed & Sign.

Usage

Step 1: Import the framework

import PaymobSDKStep 2: Add the delegate to the class, and add the protocol stubs

class ViewController: UIViewController, PaymobSDKDelegate {It should look like this.

extension ViewController: PaymobSDKDelegate{

func transactionRejected() {

print("Transaction Rejected")

}

func transactionAccepted(transactionDetails: [String : Any]) {

print("Transaction Successfull: \(transactionDetails)")

}

func transactionPending() {

print("Transaction Pending")

}

}Step 3: Create a constant

let paymob = PaymobSDK()Step 4: Pass self to delegate

paymob.delegate = selfStep 5: Create the variables

// Replace this string with your payment key

let client_secret = "" //Put Client Secret Here

let public_key = "" // Put Public Key Here

Client Secret

A unique, intention-specific token used to redirect the customer to Paymob’s Unified Checkout or to render Paymob’s Pixel component.

Public Key

Step 6: Customize the UI of the SDK

You can customize the UI of the SDK, such as

// the extra UI Customization parameters are

//sets the title to be the image you want

appIcon

//sets the title to be the name you want

appName

//changes the color of the buttons throughout the SDK, the default is black

buttonBackgroundColor

//changes the color of the buttons Texts throughout the SDK, the default is white

buttonTextColor

//set save card checkbox initial value

saveCardDefault

//set whether or not should show save card checkbox

showSaveCard

//used like this

let paymob = PaymobSDK()

paymob.paymobSDKCustomization.appIcon = UIImage()

paymob.paymobSDKCustomization.appName = ""

paymob.paymobSDKCustomization.buttonBackgroundColor = UIColor.black

paymob.paymobSDKCustomization.buttonTextColor = UIColor.white

paymob.paymobSDKCustomization.showSaveCard = truepaymob.paymobSDKCustomization.saveCardDefault = false

try paymob.presentPayVC(VC: self, PublicKey: public_key, ClientSecret: client_secret)

paymob.paymobSDKCustomization.saveCardDefault = falseStep 7: Run the SDK

do{

try paymob.presentPayVC(VC: self, PublicKey: public_key, ClientSecret: client_secret)

} catch let error {

}What made this section unhelpful for you?

On this page

- IOS SDK

Android SDK

Outcome: Integrate Paymob's native Android SDK

Manual installation

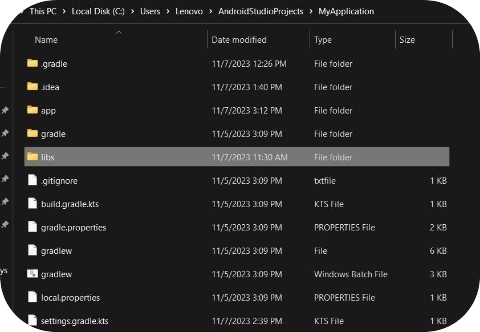

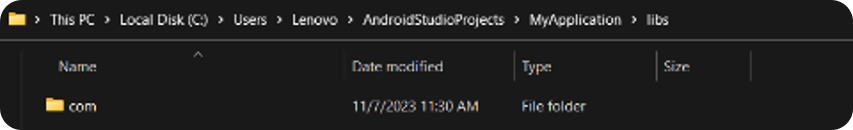

Step 1: Download SDK files (.jar/.aar)

Download the SDK from this link and unzip the “Sdk package” folder.

Step 2: Locate the SDK files in app/libs/ folder

Copy the SDK folder into the libs directory of your Android project.

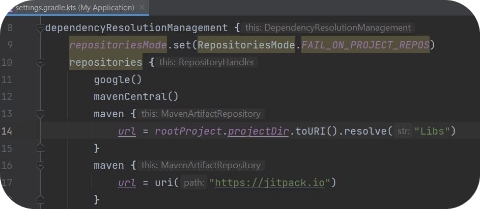

Step 3: Add the repository to settings.gradle.kts

Add required local Repositories as follows:

repositories { maven { url = rootProject.projectDir.toURI().resolve("libs") } maven { url = uri("https://jitpack.io") } }

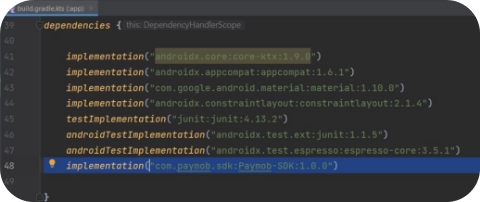

Step 4: Add a dependency in app/build.gradle.kts

implementation("com.paymob.sdk:Paymob-SDK:{{latest version}}")//Please change this version number to match the version number of the downloaded sdk

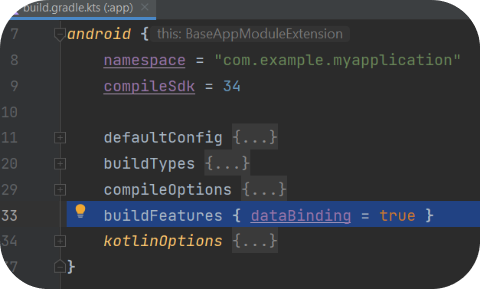

Step 5: Enable data binding in app/build.gradle.kts

Add your data-binding feature in BaseAppModuleExtensions as follows:

android { buildFeatures { dataBinding = true } }

Step 6: Sync gradle project

Usage imports

import com.paymob.paymob_sdk.PaymobSdk

import com.paymob.paymob_sdk.domain.model.CreditCard

import com.paymob.paymob_sdk.domain.model.SavedCard

import com.paymob.paymob_sdk.ui.PaymobSdkListenerImplement Paymob Sdk listener interface

class MainActivity : AppCompatActivity(), PaymobSdkListener { override fun onCreate(savedInstanceState: Bundle?) {…}

override fun onSuccess() {

//If the Payment is successful }

override fun onFailure() {

//If The Payment is declined }

override fun onPending() {

//If The Payment is pending }

}Create a PaymobSdk instance

You can create the PaymobSdk instance using PaymobSdk.Builder()

val paymobsdk = PaymobSdk.Builder(

context = this@MainActivity,

clientSecret = “CLIENT_SECRET”,//Place Client Secret here

publicKey = “PUBLIC_KEY”,//Place Public Key here

paymobSdkListener = this

)

.build()Client Secret

A unique, intention-specific token used to redirect the customer to Paymob’s Unified Checkout or to render Paymob’s Pixel component.

Public Key

You can set the SDK buttons' color and buttons' text color using this builder object, for example:

val paymobsdk = PaymobSdk.Builder(context = this@MainActivity,clientSecret = “CLIENT_SECRET”,//Place Client Secret herepublicKey = “PUBLIC_KEY”,//Place Public Key herepaymobSdkListener = this,).setButtonBackgroundColor(Color.BLACK)//changes the color of button backgrounds throughout the SDK, and set by default to black.setButtonTextColor(Color.WHITE)//changes the color of button texts throughout the SDK, and set by default to white.showSaveCard(showSaveCard ?: true) //changes the ability for the sdk to save the card info or no.saveCardByDefault(saveCardDefault ?: false) //changes the ability for the sdk if the save card checkbox is checked ot not.build()Finally: Run the SDK

You can start the SDK by calling

sdk.start()What made this section unhelpful for you?

On this page

- Android SDK

Flutter SDK

Outcome: Integrate Paymob's native SDKs using a Flutter bridge

The Flutter SDK works as a bridge that connects your Flutter app to the native iOS and Android Paymob SDKs.

Dart section

Import dependency

- Redirect into your Dart file.

- Import the following dependency.

import 'package:flutter/services.dart';Add the code that will call the SDK

Add the following code to the same file.

This is the function that you will call in your Dart file when you need to call the SDK.

You need to pass the public and client secret keys to this function. These two parameters are required. The other parameters are optional.

static const methodChannel = MethodChannel('paymob_sdk_flutter'); // Method to call native PaymobSDKs Future<void> _payWithPaymob( String pk, String csk, { String? appName, Color? buttonBackgroundColor, Color? buttonTextColor, bool? saveCardDefault, bool? showSaveCard} ) async { try { final String result = await methodChannel.invokeMethod('payWithPaymob', { "publicKey": pk, "clientSecret": csk, "appName": appName, "buttonBackgroundColor": buttonBackgroundColor?.value, "buttonTextColor": buttonTextColor?.value, "saveCardDefault": saveCardDefault, "showSaveCard": showSaveCard }); print('Native result: $result'); switch (result) { case 'Successfull': print('Transaction Successfull'); // Do something for accepted break; case 'Rejected': print('Transaction Rejected'); // Do something for rejected break; case 'Pending': print('Transaction Pending'); // Do something for pending break; default: print('Unknown response'); // Handle unknown response } } on PlatformException catch (e) { print("Failed to call native SDK: '${e.message}'."); } }Client Secret

A unique, intention-specific token used to redirect the customer to Paymob’s Unified Checkout or to render Paymob’s Pixel component.

Public Key

Optional parameters

The following are optional Parameters that are used to customize the SDK

// the extra UI Customization parameters are//sets the header to be the name you wantappName//changes the color of the buttons throughout the SDK, the default is blackbuttonBackgroundColor//changes the color of the buttons Texts throughout the SDK, the default is whitebuttonTextColor//set save card checkbox initial valuesaveCardDefault//set whether or not should show save card checkboxshowSaveCardIOS section

Download the SDK

You can download the SDK from this link and extract it on the local machine.

Locate SDK files in the project directory

Physically place the SDK files in your project folder structure

Add SDK to frameworks, libraries, and embedded content

Drag and drop the PaymobSDK.xcframework folder into Frameworks, Libraries, and Embedded Content under the General Settings of Xcode.

Change the embedding option to "Embed & Sign"

In the general settings of your project, under Frameworks, Libraries, and Embedded Content, change the library from "Do not embed" to "Embed and Sign"

Import the framework

In your AppDelegate file. Add the following import

import PaymobSDKCreate a global variable

var SDKResult: FlutterResult?Code to handle receiving a call from Dart

Add the following code to handle receiving a call from the Dart file

let controller : FlutterViewController = window?.rootViewController as! FlutterViewController let nativeChannel = FlutterMethodChannel(name: "paymob_sdk_flutter", binaryMessenger: controller.binaryMessenger) nativeChannel.setMethodCallHandler { (call: FlutterMethodCall, result: @escaping FlutterResult) -> Void in if call.method == "payWithPaymob", let args = call.arguments as? [String: Any]{ self.SDKResult = result self.callNativeSDK(arguments: args, VC: controller) } else { result(FlutterMethodNotImplemented) } }Code to handle calling the native PaymobSDK

// Function to call native PaymobSDK

private func callNativeSDK(arguments: [String: Any], VC: FlutterViewController) {

// Initialize Paymob SDK

let paymob = PaymobSDK()

paymob.delegate = self

//customize the SDK

if let appName = arguments["appName"] as? String{

paymob.paymobSDKCustomization.appName = appName

}

if let buttonBackgroundColor = arguments["buttonBackgroundColor"] as? NSNumber{

let colorInt = buttonBackgroundColor.intValue

let alpha = CGFloat((colorInt >> 24) & 0xFF) / 255.0

let red = CGFloat((colorInt >> 16) & 0xFF) / 255.0

let green = CGFloat((colorInt >> 8) & 0xFF) / 255.0

let blue = CGFloat(colorInt & 0xFF) / 255.0

let color = UIColor(red: red, green: green, blue: blue, alpha: alpha)

paymob.paymobSDKCustomization.buttonBackgroundColor = color

}

if let buttonTextColor = arguments["buttonTextColor"] as? NSNumber{

let colorInt = buttonTextColor.intValue

let alpha = CGFloat((colorInt >> 24) & 0xFF) / 255.0

let red = CGFloat((colorInt >> 16) & 0xFF) / 255.0

let green = CGFloat((colorInt >> 8) & 0xFF) / 255.0

let blue = CGFloat(colorInt & 0xFF) / 255.0

let color = UIColor(red: red, green: green, blue: blue, alpha: alpha)

paymob.paymobSDKCustomization.buttonTextColor = color

}

if let saveCardDefault = arguments["saveCardDefault"] as? Bool{

paymob.paymobSDKCustomization.saveCardDefault = saveCardDefault

}

if let showSaveCard = arguments["showSaveCard"] as? Bool{

paymob.paymobSDKCustomization.showSaveCard = showSaveCard

}

// Call Paymob SDK with publicKey and clientSecret

if let publicKey = arguments["publicKey"] as? String,

let clientSecret = arguments["clientSecret"] as? String{

do{

try paymob.presentPayVC(VC: VC, PublicKey: publicKey, ClientSecret: clientSecret)

} catch let error {

print(error.localizedDescription)

}

return

}

}Code to handle the result of the SDK

Add the following at the bottom to handle the result of the SDK

extension AppDelegate: PaymobSDKDelegate {

public func transactionAccepted(transactionDetails: [String: Any]) {

self.SDKResult?(["status": "Successfull", "details": transactionDetails])

}

public func transactionRejected(message : String) {

self.SDKResult?("Rejected")

}

public func transactionPending() {

self.SDKResult?("Pending")

}

}Android Section

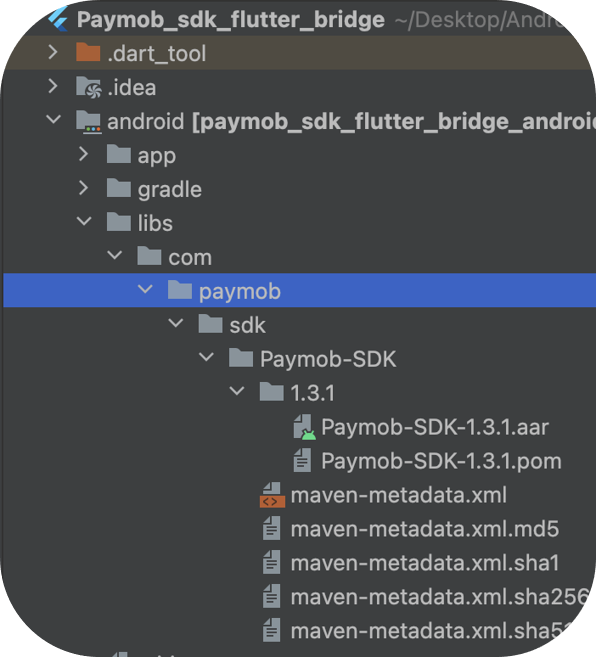

Download SDK files (.jar/.aar)

Download the SDK from this link and unzip the “Sdk package” folder.

Locate the SDK files in app/libs/ the folder

Redirect into the Android directory.

Then, create a new directory there called 'libs' and place the Android SDK there

Add repository

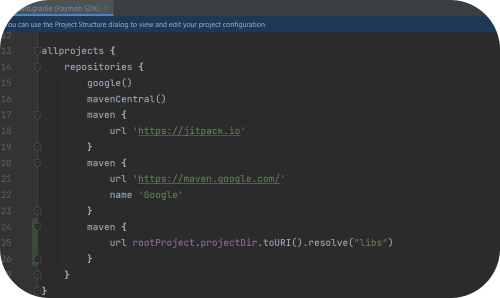

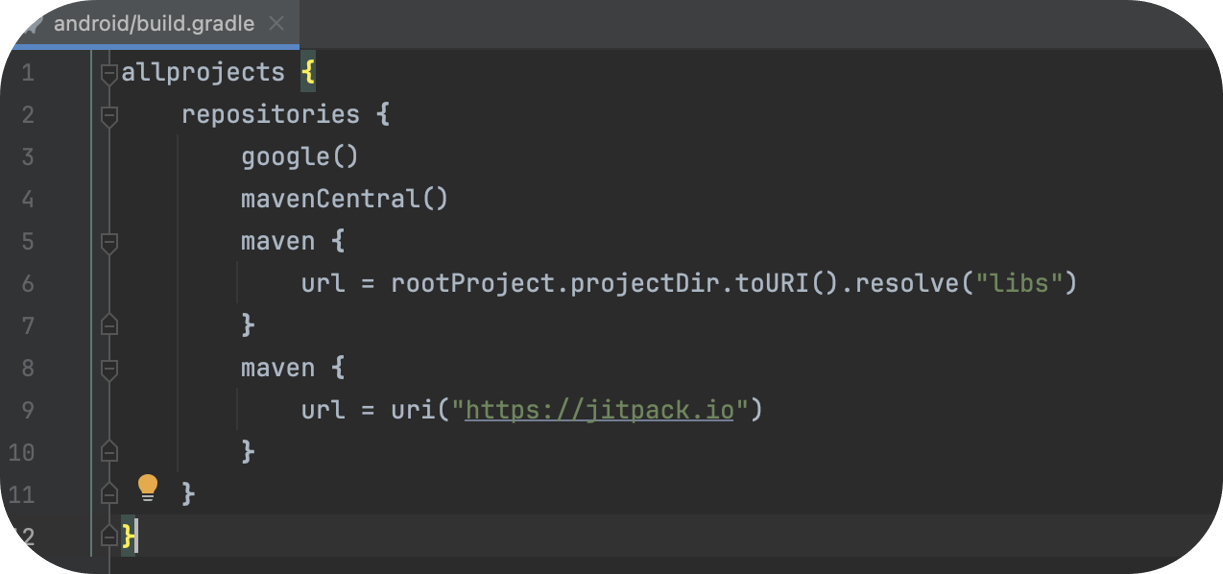

Inside the root Android directory, open the build.gradle, Then, add the code below inside

allprojects { repositories { ... maven { url = rootProject.projectDir.toURI().resolve("libs") } maven { url = uri("https://jitpack.io") } }}should look like this.

Then open the settings.gradle, Then add the following code

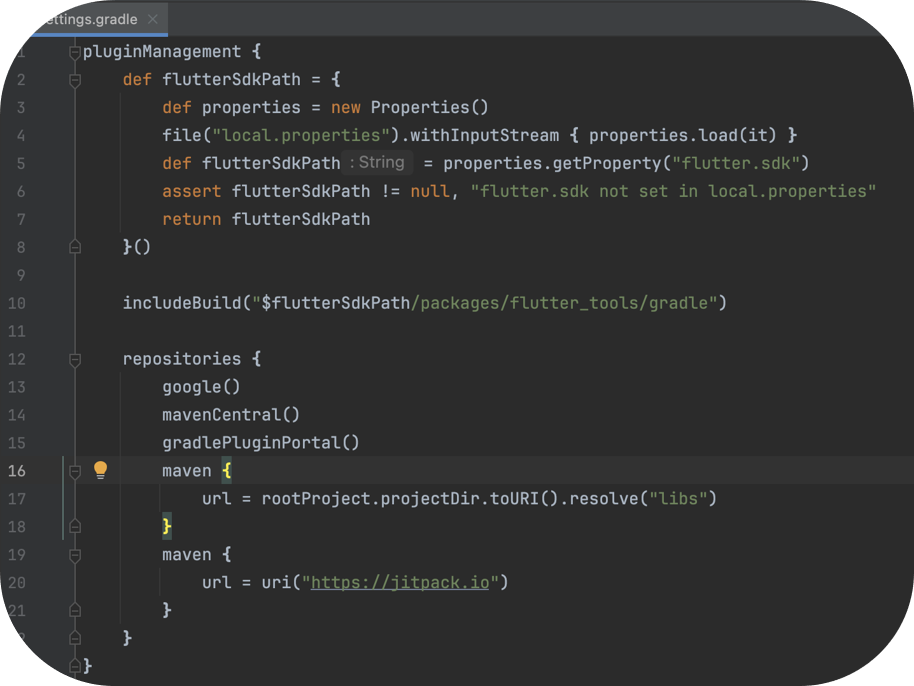

pluginManagement { repositories { ... maven { url = rootProject.projectDir.toURI().resolve("libs") } maven { url = uri("https://jitpack.io") }should look like this

Add dependency and enable databinding

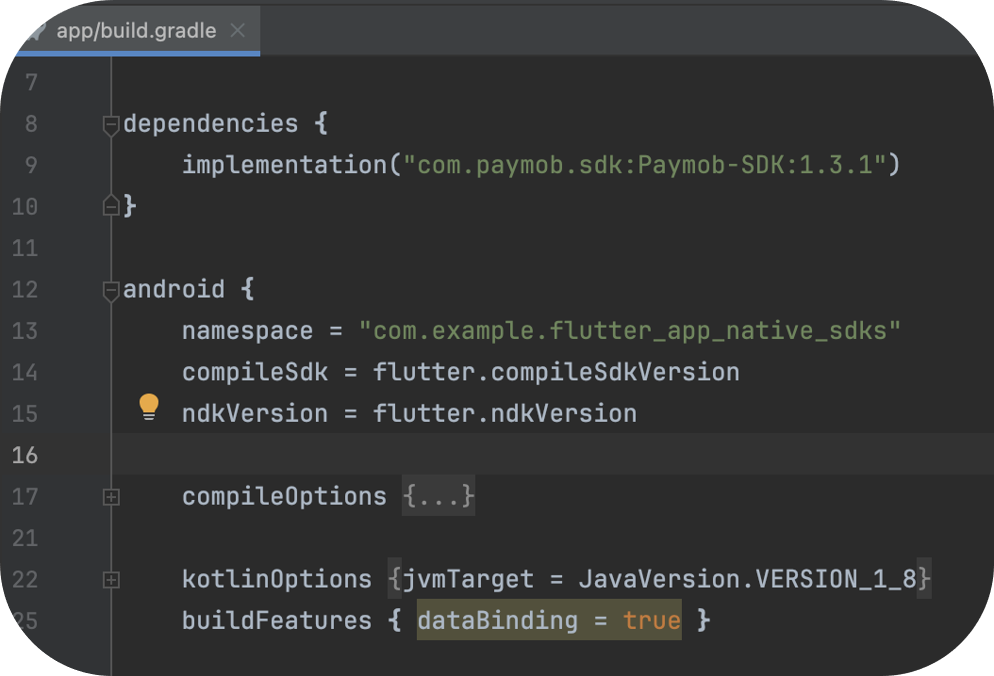

Inside the app directory, open the build.gradle file and add the following

dependencies { implementation("com.paymob.sdk:Paymob-SDK:{{latest version}}")//Please change this version number to match the version number of the downloaded sdk}android { ... buildFeatures { dataBinding = true }}should look like this

Code to handle receiving a call from Dart, calling the native SDK, and handling the result of the SDK

Then, in the MainActivity, add the following:

import android.graphics.Color

import android.util.Log

import io.flutter.plugin.common.MethodCall

import io.flutter.plugin.common.MethodChannel

import io.flutter.plugin.common.MethodChannel.MethodCallHandler

import io.flutter.plugin.common.MethodChannel.Result

import io.flutter.embedding.android.FlutterActivity

import android.os.Bundle

import android.widget.Toast

import com.paymob.paymob_sdk.PaymobSdk

import com.paymob.paymob_sdk.domain.model.CreditCard

import com.paymob.paymob_sdk.domain.model.SavedCard

import com.paymob.paymob_sdk.ui.PaymobSdkListener

class MainActivity: FlutterActivity(), MethodCallHandler, PaymobSdkListener {

private val CHANNEL = "paymob_sdk_flutter"

private var SDKResult: MethodChannel.Result? = null

override fun onCreate(savedInstanceState: Bundle?) {

super.onCreate(savedInstanceState)

flutterEngine?.dartExecutor?.binaryMessenger?.let {

MethodChannel(it, CHANNEL).setMethodCallHandler { call, result ->

if (call.method == "payWithPaymob") {

SDKResult = result

callNativeSDK(call)

} else {

result.notImplemented()

}

}

}

}

// Function to call native PaymobSDK

private fun callNativeSDK(call: MethodCall) {

val arguments = call.arguments as? Map<String, Any>

val publicKey = call.argument<String>("publicKey")

val clientSecret = call.argument<String>("clientSecret")

var buttonBackgroundColor: Int? = null

var buttonTextColor: Int? = null

val appName = call.argument<String>("appName")

val buttonBackgroundColorData = call.argument<Number>("buttonBackgroundColor")?.toInt() ?: 0

val buttonTextColorData = call.argument<Number>("buttonTextColor")?.toInt() ?: 0

val saveCardDefault = call.argument<Boolean>("saveCardDefault") ?: false

val showSaveCard = call.argument<Boolean>("showSaveCard") ?: true

if (buttonTextColorData != null){

buttonTextColor = Color.argb(

(buttonTextColorData shr 24) and 0xFF, // Alpha

(buttonTextColorData shr 16) and 0xFF, // Red

(buttonTextColorData shr 8) and 0xFF, // Green

buttonTextColorData and 0xFF // Blue

)

}

Log.d("color", buttonTextColor.toString())

if (buttonBackgroundColorData != null){

buttonBackgroundColor = Color.argb(

(buttonBackgroundColorData shr 24) and 0xFF, // Alpha

(buttonBackgroundColorData shr 16) and 0xFF, // Red

(buttonBackgroundColorData shr 8) and 0xFF, // Green

buttonBackgroundColorData and 0xFF // Blue

)

}

val paymobsdk = PaymobSdk.Builder(

context = this@MainActivity,

clientSecret = clientSecret.toString(),

publicKey = publicKey.toString(),

paymobSdkListener = this,

).setButtonBackgroundColor(buttonBackgroundColor ?: Color.BLACK)

.setButtonTextColor(buttonTextColor ?: Color.WHITE)

.setAppName(appName) .showSaveCard(showSaveCard ?: true)

.saveCardByDefault(saveCardDefault ?: false)

.build()

paymobsdk.start()

return

}

//PaymobSDK Return Values

override fun onSuccess() {

//If The Payment is Accepted

SDKResult?.success("Successfull")

}

override fun onFailure() {

//If The Payment is declined

SDKResult?.success("Rejected")

}

override fun onPending() {

//If The Payment is pending

SDKResult?.success("Pending")

}

override fun onMethodCall(call: MethodCall, result: Result) {

}

}What made this section unhelpful for you?

On this page

- Flutter SDK

React Native SDK

Outcome: Integrate Paymob's React Native SDK

Installation Steps for React Native SDK

To get started with the paymob-reactnative package, follow these steps:

- Open your terminal, navigate to your React Native project directory, and install the

paymob-reactnativepackage using yarn:

yarn add paymob-reactnative@https://github.com/PaymobAccept/paymob-reactnative-sdk.git

iOS

Install CocoaPods for iOS

If you’re building for iOS, you’ll need CocoaPods to link the native SDK correctly.

From your project root, run:

This step ensures that the necessary native modules are linked correctly in your iOS project.

Android

Add the dependency repository

AAdd the following snippet to your project-level build.gradlefile.

allprojects { repositories { maven { url = rootProject.projectDir.toURI().resolve("../node_modules/paymob-reactnative/android/libs") } maven { url = uri("https://jitpack.io") } }}Enable data binding

Add the following snippet to your app-level build.gradlefile.

android { buildFeatures { dataBinding = true }}Using Paymob

To begin using the Paymob SDK in your react native application, start by importing the module in your component:

import Paymob, { PaymentResult, CreditCardType } from 'paymob-reactnative';Customize the SDK

You can adjust the SDK’s look and behavior to match your app’s branding before showing the payment screen.

Paymob.setAppIcon(base64Image); // Set your merchant logo using a base64 encoded image

Paymob.setAppName('Paymob SDK'); // Customize merchant app name displayed in the Paymob interface

Paymob.setButtonTextColor('#FFFFFF'); // Set the text color of buttons in the SDK

Paymob.setButtonBackgroundColor('#000000'); // Set the background color of buttons in the SDK

Paymob.setShowSaveCard(true); // Enable the option for users to save their cards

Paymob.setSaveCardDefault(true); // Set saved card option as default for transactionsThese options help keep the payment experience consistent with your app’s design.

Listen for payment results

To handle payment results effectively, you can add a listener that will respond to different transaction statuses. This is crucial for providing feedback to users about their payment transactions:

Paymob.setSdkListener((status: PaymentResult) => {

switch (status) {

case PaymentResult.SUCCESS:

// Handle successful payment

break;

case PaymentResult.FAIL:

// Handle failed payment

break;

case PaymentResult.PENDING:

// Handle pending payment status

break;

}

});This listener will allow you to implement logic based on the result of the payment process, enhancing the user experience.

Invoking the SDK

After configuring the SDK, you can invoke the Paymob payment interface with the following code:

const savedBankCards = [

{

maskedPan: '1234', // The masked card number displayed to the user

savedCardToken: 'CARD_TOKEN', // The token representing the saved card

creditCard: CreditCardType.MASTERCARD, // The type of the credit card (e.g., Mastercard)

},

];

Paymob.presentPayVC('CLIENT_SECRET', 'PUBLIC_KEY', savedBankCards);Note: The savedBankCards parameter is optional. If you do not have saved bank cards to provide, you can simply call the presentPayVC method without it.

This function call opens the Paymob payment interface, allowing users to complete their transactions securely. Make sure to replace 'CLIENT_SECRET' and 'PUBLIC_KEY' with your actual credentials.

Here’s the updated explanation with a revised first sentence and the inclusion of the repository cloning step:

Example App

To explore the SDK or test its features, you can clone the repository and run the example app by following these steps:

- Clone the RepositoryClone the repository to your local machine.

yarn

2. Run the Example App

You can run the example app for both iOS and Android platforms:

- To run the app on iOS, use the following command:

yarn example ios

- To run the app on Android, use this command:

yarn example android

By following these steps, you can explore the functionality of the SDK in the example app.

What made this section unhelpful for you?

On this page

- React Native SDK

Overview

Outcome: Understand the different types of Paymob callbacks, their purposes, and HMAC calculation.

Definition

Transaction callbacks are mechanisms used by Paymob to notify your system about payment-related events and transaction statuses. They ensure your platform stays in sync with what happens during and after a customer completes a payment.

When does Paymob send the transaction callback?

Paymob sends the transaction callback only if the transaction succeeds or is declined

Types of Transaction Callbacks

Paymob provides two types of transaction callbacks to keep both your system and your customers informed about payment results:

Transaction Processed Callback

Used to notify your backend system about transaction events and status changes, allowing you to update orders, trigger business logic, and keep your records in sync.

Transaction Response Callback

Used to redirect the customer back to your platform after payment, so you can display the payment result and guide the next user action.

Each callback serves a different purpose and is designed to support both system-level handling and customer-facing communication. Detailed technical implementation for each callback is covered in the following sub-page.

What made this section unhelpful for you?

On this page

- Overview

Transaction callbacks

Outcome: Understand the different types of Paymob callbacks and the purpose of each one.

Transaction Processed Callback

This is an endpoint in your web application where you will receive notifications with the transaction details after the payment or after any action on the payment. The callback will be sent as a POST request containing a JSON object with key details about the transaction.

Main keys to observe their values:

id ⇒ Transaction ID

success ⇒ Status of the transaction (True/False)

order.id ⇒ Paymob order ID, which you'll mostly use to correlate between the transaction you received its callback and the order on your system, which you bound to the Paymob order ID while creating the intention.

is_refunded ⇒ Indicates whether the transaction has been refunded or not (True/False)

refunded_amount_cents ⇒ The total of the refunded amount. (The payment transaction can have more than one partial refund transaction)

is_voided ⇒ Indicates whether the transaction has been voided or not (True/False)

is_captured ⇒ Indicates whether the transaction has been captured or not (True/False)

captured_amount ⇒ The total of the captured amount. (The payment transaction can have more than one partial capture transaction)

On the right side of this page, you'll see an example of a request that you would receive on your transaction-processed callback endpoint for a successful transaction. While you don’t need to use all the keys included, the table below describes some of the key details within the callback object:

Transaction Response Callback

After a customer completes a payment, Paymob will redirect them back to your platform on the URL you'll specify as a response callback URL in the integration ID. Prepare this endpoint to show a page with a clear message indicating the status of the payment they just made.

The transaction response callback consists of a set of query parameters that we append to the URL of your endpoint. After the payment is processed, we will redirect the customer to this endpoint. You can then parse these parameters and display an appropriate message to the customer based on the payment status.

These query parameters correspond to the same keys found in the transaction processed callback JSON object listed in the above table.

Transaction Response Callback sample:

https://webhook.site/de237c03-271f-40ba-8327-f667ce71ee90?id=316004&pending=false&amount_cents=50000&success=true&is_auth=false&is_capture=false&is_standalone_payment=true&is_voided=false&is_refunded=false&is_3d_secure=true&integration_id=2936&profile_id=106&has_parent_transaction=false&order=378804&created_at=2024-06-25T15%3A16%3A25.910710%2B04%3A00¤cy=EGP&merchant_commission=0&discount_details=%5B%5D&is_void=false&is_refund=false&error_occured=false&refunded_amount_cents=0&captured_amount=0&updated_at=2024-06-25T15%3A16%3A46.544538%2B04%3A00&is_settled=false&bill_balanced=false&is_bill=false&owner=211&data.message=Approved&source_data.type=card&source_data.pan=2346&source_data.sub_type=MasterCard&acq_response_code=00&txn_response_code=APPROVED&hmac=8aa3e005de7f639dac10952884963d47a65b2b85d3381803b3f22ff2cd372e57ef881dea2c94a9e171c9df7cef4fd898f2fc92f229dc4369d61d5acfb6b311ce

Transaction Processed Callbacks vs Transaction Response Callbacks

Request Type | POST | GET |

Request Content | JSON | Query Param |

Direction | Server Side | Client Side |

Useful Testing Tools

To receive transaction callbacks, your app must be deployed on a publicly accessible endpoint. If you are developing your app locally and need to test receiving callbacks, you may need to set up a secure, introspectable tunnel to your localhost webhook. One recommended tool for this is ngrok, which generates a public URL that you can use as your callback URL.

If you are not receiving callbacks and need to debug the issue, you can use one of the following HTTP request inspection tools: Webhook, RequestBin, or RequestWatch. These tools generate endpoint URLs that you can add to your transaction processed/response callbacks, allowing you to verify whether the callbacks are being received after a payment is processed.

Transaction Callbacks

The unique identifier for this transaction. You can find this ID in the "Transaction" tab of your Merchant portal

The complete transaction object containing all relevant details related to the callback event

Show child attributes

The name or identifier of the bank that issued the payment method used in the transaction

An array containing responses received from downstream systems after processing the transaction callback

What made this section unhelpful for you?

What made this section unhelpful for you?

HMAC

Who is this for: Technical product managers and developers who need to understand how they can authenticate Paymob callbacks.

Outcome: Understand the HMAC calculation mechanism.

What is HMAC Authentication?

HMAC (Hash-based Message Authentication Code) is a widely used cryptographic technique designed to ensure both the integrity and authenticity of a message. It combines a cryptographic hash function (such as SHA-512) with a secret key and a string of data to produce a unique signature, known as an HMAC. This signature serves as a guarantee that the message has not been altered during transmission and confirms the identity of the sender.

Whenever you receive a callback from Accept, even if it's (Processed, Response, or Card token), it includes an HMAC query parameter. You should calculate the HMAC using the received data and compare it with the provided value to verify the callback’s authenticity.

Calculation steps guidelines

At a high level, HMAC authentication works as follows:

- Paymob sends transaction data along with an HMAC value.

- You recreate this HMAC using the received data and your hmac secret key.

- You compare your generated HMAC with the one received.

- If both values match, the callback is verified and trusted.

This mechanism ensures that your system only processes valid callbacks sent by Paymob.

On this page

- HMAC

Refund

Outcome: Refund transactions through API

Authorization

Add your “secret key“ in the authorization header preceded by the word ”Token ”.

Header Parameters

Bearer token authentication. Format: "Token YOUR_SECRET_KEY"

Body Parameters

The transaction ID you want to refund (Integer).

The amount will be refunded (Integer)

Response

Response Attributes

Unique identifier for the transaction

Indicates whether the transaction is still pending

Transaction amount in cents

Indicates whether the transaction was successful

Indicates if this is an authorization transaction

Indicates if this is a capture transaction

Indicates if this is a standalone payment

Indicates if the transaction has been voided

Indicates if the transaction has been refunded

Indicates if 3D Secure authentication was used

The integration ID used for this transaction

The merchant profile ID

Indicates if this transaction has a parent transaction

Order details associated with this transaction

Show child attributes

Timestamp when the record was created

Currency code (e.g., EGP, USD)

Show child attributes

Show child attributes

Indicates if the transaction is hidden

Payment key claims data

Indicates if an error occurred during processing

Indicates if this is a live (production) transaction

Reference from external endpoint

The amount that has been refunded in cents

Source identifier

Indicates if the transaction has been captured

The amount that has been captured in cents

Staff tag for merchant tracking

Timestamp when the record was last updated

Indicates if the transaction has been settled

Indicates if the bill is balanced

Indicates if this is a bill payment

Owner identifier

Parent transaction ID

What made this section unhelpful for you?

Base URL

Production:

Sandbox:

Response

What made this section unhelpful for you?

Void

Outcome: Void transactions through API

Authorization

Add your “secret key“ in the authorization header preceded by the word ”Token ”.

Header Parameters

Bearer token authentication. Format: "Token YOUR_SECRET_KEY"

Body Parameters

The transaction ID you want to refund (Integer).

Response

Response Attributes

Unique identifier for the transaction

Indicates whether the transaction is still pending

Transaction amount in cents

Indicates whether the transaction was successful

Indicates if this is an authorization transaction

Indicates if this is a capture transaction

Indicates if this is a standalone payment

Indicates if the transaction has been voided

Indicates if the transaction has been refunded

Indicates if 3D Secure authentication was used

The integration ID used for this transaction

The merchant profile ID

Indicates if this transaction has a parent transaction

Order details associated with this transaction

Show child attributes

Timestamp when the record was created

Currency code (e.g., EGP, USD)

Show child attributes

Show child attributes

Indicates if the transaction is hidden

Payment key claims data

Indicates if an error occurred during processing

Indicates if this is a live (production) transaction

Reference from external endpoint

The amount that has been refunded in cents

Source identifier

Indicates if the transaction has been captured

The amount that has been captured in cents

Staff tag for merchant tracking

Timestamp when the record was last updated

Indicates if the transaction has been settled

Indicates if the bill is balanced

Indicates if this is a bill payment

Owner identifier

Parent transaction ID

What made this section unhelpful for you?

Base URL

Production:

Sandbox:

Response

What made this section unhelpful for you?

Capture

Outcome: Capture Auth transactions through API

Authorization

Add your “secret key“ in the authorization header preceded by the word ”Token ”.

Header Parameters

Bearer token authentication. Format: "Token YOUR_SECRET_KEY"

Body Parameters

The transaction ID you want to refund (Integer).

The amount will be refunded (Integer)

Response

Response Attributes

Unique identifier for the transaction

Indicates whether the transaction is still pending

Transaction amount in cents

Indicates whether the transaction was successful

Indicates if this is an authorization transaction

Indicates if this is a capture transaction

Indicates if this is a standalone payment

Indicates if the transaction has been voided

Indicates if the transaction has been refunded

Indicates if 3D Secure authentication was used

The integration ID used for this transaction

The merchant profile ID

Indicates if this transaction has a parent transaction

Order details associated with this transaction

Show child attributes

Timestamp when the record was created

Currency code (e.g., EGP, USD)

Show child attributes

Show child attributes

Indicates if the transaction is hidden

Payment key claims data

Indicates if an error occurred during processing

Indicates if this is a live (production) transaction

Reference from external endpoint

The amount that has been refunded in cents

Source identifier

Indicates if the transaction has been captured

The amount that has been captured in cents

Staff tag for merchant tracking

Timestamp when the record was last updated

Indicates if the transaction has been settled

Indicates if the bill is balanced

Indicates if this is a bill payment

Owner identifier

Parent transaction ID

What made this section unhelpful for you?

Base URL

Production:

Sandbox:

Response

What made this section unhelpful for you?

Create Subscription plan

Outcome: Create a subscription plan that defines the characteristics of periodic subscription deductions per user.

Authorization

You should send a valid auth token as a Bearer Token.

Header Parameters

Bearer token authentication. Format: "Token YOUR_SECRET_KEY"

Body Parameters

Specify the frequency of deduction (e.g., Weekly, Biweekly, Monthly, Two months, Quarterly, Half annual, Yearly). Values in numbers are (7, 15, 30, 60, 90, 180, 360).

Name the subscription plan for identification purposes. The maximum number of characters is 200.

You need to enter the unique webhook URL in this parameter

Specify the number of days before which you want to send a notification to the customer to pay (currently supporting email notifications).

Define the days on which the subscription will be attempted again in case of a failure to collect the previous subscription amount.

The type of subscription plan. It accepts the values (rent) and the default is “rent.”

The number of deductions from this subscription. The default value is null.

Specify the subscription amount that will be charged.

If this flag is enabled, the system will use the first transaction amount instead of the specified subscription amount. Otherwise, it will use the subscription amount from the “Amount Cents”. Default value is false

Indicates whether the plan will be created, will be active, or will be paused. The default value is true.

MIGS Moto Integration ID, which will be used for upcoming transactions (recurring transactions).

Response

Response Attributes

Unique identifier for the transaction

Timestamp when the record was created

Timestamp when the record was last updated

Name of the item

Transaction amount in cents

Indicates if the subscription is active

What made this section unhelpful for you?

Base URL

Production:

Sandbox:

Response

What made this section unhelpful for you?

Create Subscription

Outcome: Create a subscription for a user under a specific subscription plan.

Subscription Creation Mechanism

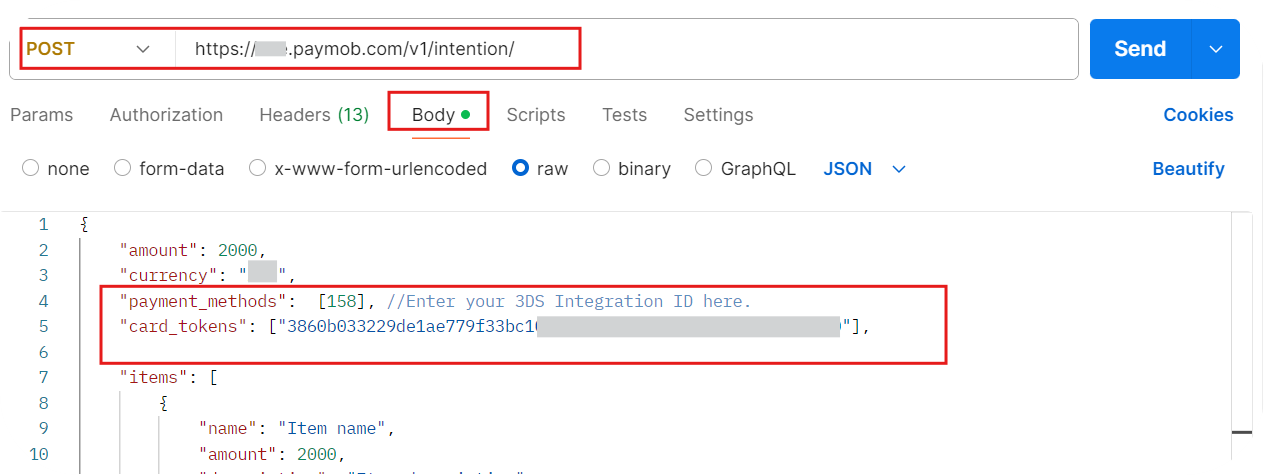

Subscription creation is being done by completing one 3DS transaction to save the customer's card and connect it with the subscription. To implement this, please check the Create Intention API documentation

Below are the specific technical details related to the subscription itself, not the Intention in general.

What made this section unhelpful for you?

On this page

- Create Subscription

Plan actions

Outcome: know briefly the actions that can be executed on the subscription plan.

Overview

There are some actions that can be executed on the subscription plan through APIs.

Actions can be executed on the subscription plan

- Update the parameters (number of deductions, plan amount, Moto integration ID)

- Suspend the plan temporarily

- Resume a suspended plan

- List the plans

Endpoints

Subscription actions

Outcome: A brief about the actions that can be executed on the subscription plans

Overview

There are some actions that can be executed on the subscription plan through APIs.

Actions can be executed on the subscription plan

- Update the parameters (number of deductions, plan amount, Moto integration ID)

- Suspend the plan temporarily

- Resume a suspended plan

- List the plans

Endpoints

HMAC Calculation for Subscription Callback

Outcome: Calculate HMAC for Subscription callback

When a webhook is registered to a subscription, any actions performed on the subscription will trigger a callback. This callback is sent as a POST request to the registered webhook, containing the updated subscription data. The HMAC value for this callback is provided in the body of the subscription callback request as a parameter named hmac (unlike transaction or card token callbacks, where it is typically sent as a query parameter).

Subscription Callback Sample

{

"paymob_request_id": "df9e4ecf-12e0-4925-b258-65423f32bc98",

"subscription_data": {

"id": 1264,

"client_info": {

"email": "test@test.com",

"full_name": "mo ay",

"phone_number": "01010101010"

},

"frequency": 365,

"created_at": "2024-12-03T22:11:02.280164",

"updated_at": "2024-12-03T22:11:02.280179",

"name": "Testplan 3",

"reminder_days": null,

"retrial_days": null,

"plan_id": 1186,

"state": "suspended",

"amount_cents": 330,

"starts_at": "2024-12-20",

"next_billing": "2024-12-20",

"reminder_date": null,

"ends_at": null,

"resumed_at": null,

"suspended_at": "2024-12-03",

"webhook_url": "https://webhook.site/a16ba9d5-4f4a-47dc-8005-e6ec2d197f26",

"integration": 4565330,

"initial_transaction": 241322967

},

"trigger_type": "suspended",

"hmac": "dd5b3018888d9f98574cd180793db10d969b522e08c62baf2ea33357d1546b567b7fd79760e90046e90eaacf30024ede5539cbd0748bd9e6c005faf5117e0e7b"

}HMAC Calculation Method

1. Extract the Relevant Parameters

subscription_data.id: Subscription ID (1264in the example).trigger_type: The action taken on the subscription (suspendedin the example).

2. Create the Concatenated String

The string format is the concatenation of the trigger_type + “for” + subscription_data.id

”{trigger_type}for{subscription_data.id}”

Example: The string for the above object is “suspendedfor1264“

3. Hash the String

- Use the

SHA-512hashing algorithm. - Hash the concatenated string using the merchant’s HMAC secret key. (This step is the same as calculating HMAC for normal callbacks)

4. Compare the HMAC

Compare the HMAC value sent in the request body (hmac parameter) with the calculated HMAC. If they match, the request is authenticated.

What made this section unhelpful for you?

On this page

- HMAC Calculation for Subscription Callback

Create Card Token

Outcome: Create a Card Token to be used in future payments

What made this section unhelpful for you?

On this page

- Create Card Token

CIT (Customer Initiated Transaction)

Outcome: Make the customer pay with the saved card through one of Paymob UIs without reentering his card details

Pre-requisites

- Create a card token, you can check the Create Card Token guide.

What made this section unhelpful for you?

On this page

- CIT (Customer Initiated Transaction)

MIT (Merchant Initiated Transaction)

Outcome: Make the merchant deduct from a saved card without the customer's interaction

Pre-requisites

- Create a card token, you can check the Create Card Token guide.

Body Parameters

Show child attributes

A unique identifier for payment with specific payment method.

What made this section unhelpful for you?

What made this section unhelpful for you?

Overview

Outcome: Understand what QuickLinks APIs are used for

QuickLinks APIs allow you to programmatically create and manage payment links using Paymob’s backend APIs. These links can then be shared with customers to complete payments through a Paymob-hosted checkout experience.

What Are QuickLinks APIs?

QuickLinks APIs enable you to:

- Create secure, Paymob-hosted payment links programmatically

- Define payment details such as amount, currency, and allowed payment methods

- Cancel payment links from your backend

Once created, a QuickLink can be shared with customers through any communication channel, allowing them to complete the payment without additional integration steps.

Available API Operations

Create QuickLink

Use this API to generate a new payment link with predefined payment details and configurations.

Cancel QuickLink

Use this API to invalidate an existing payment link and prevent it from being used for future payments.

What made this section unhelpful for you?

On this page

- Overview

Create QuickLink

Outcome: Create a QuickLink through API

Authorization

You should send a valid auth token as a Bearer Token.

Header Parameters

Bearer token authentication. Format: "Token YOUR_SECRET_KEY"

Body Parameters

Image file to be displayed on the payment link page. Supported formats include common image types (e.g., PNG, JPG).

Transaction amount in cents (e.g., 5500 = 55.00).

Expiration date and time for the payment link in ISO 8601 format (YYYY-MM-DDTHH:MM: SS).